Table of Contents

2022 W-4 Form – W4 Form 2022 – In the field of taxation, many aren’t familiar with the terminology employed. It’s not just that, the IRS has a variety of forms that, for certain individuals, can be difficult to comprehend all the forms. One of the forms you must fill in are The W4 Form. What exactly is this form? You will find the answer in this article.

What is W4 Form?

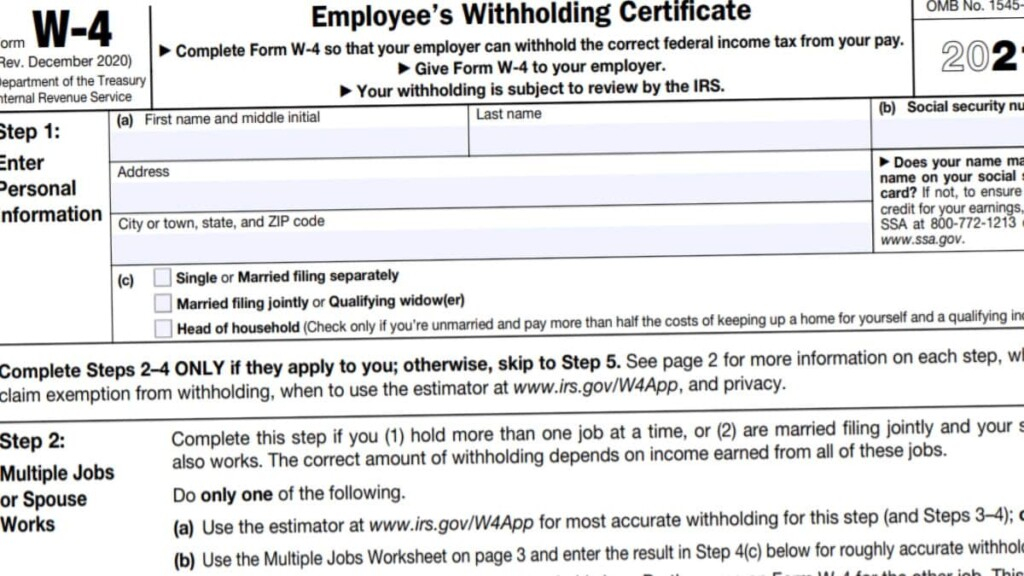

The 2022 W-4 Form is also known by its alternate name, ‘Employee Withholding Certificate.’ The Form is issued by the Internal Revenue Service (IRS) under the Department of the Treasury. Each year the IRS issues a new W4 Form despite the identicality every year’s Form is similar.

This 2022 W-4 Form is mandatory to be completed by an employee of a firm. Why is this? This is to inform the employer about what additional job as well as the number of children and dependents you have. Informing your employer about this your employer, it will allow you in adjusting the deductible tax deduction from your pay.

What Parts Does W4 Form Have?

There are a lot of sections available to fill in the Form. The Form itself has four pages, however the functional one is the first one. Parts of the Form W4 will be explained as follows:

- The first page is comprised of the forms that you have to fill in. On the 2021 W4 form you’ll notice the steps needed to fill in the blanks in this form.

- The second and third pages comprise general instructions and the specific instructions you may refer to if you’re confused on how to fill the form available on the first page. The information available in this section is comprehensive enough to guide you on how to fill in the blanks however.

- The final page (fourth page)–consists of a table that will tell that you how much tax withheld from your pay check.

How to Fill W4 Form

- First, download the form from the official website for the IRS.

- Open it by opening the W4 Form using a PDF reader.

- Once you’ve opened the file, ensure to go through the general instructions and then the specific instructions which are on the third and the second pages.

- Once you’ve finished reading the directions, you are now able to start filling in the form by starting at Step 1 Personal Information.

- Step 2 until step 4 may be skipped if you don’t have the answers to the questions on the Form. You’re not considered a subject for these steps if you are single, working only, and don’t have children or dependents living with you.

- If any of the above steps are applicable to you, then fill in the blanks by giving a correct and honest answer. Don’t worry since there is guidance that tells you how to fill in the blanks, which you can understand after reading the general instructions and the specific instructions. The instructions which are written about the steps can help you.

- Once you’ve completed the form, proceed to step 5. In this step, you need to take a signature on the form and record the date that you sign the W4 Form.

- As the last step, give it over to your employer.

We hope that this information about 2022 W-4 Form will be useful to you. Be sure to not exceed the deadline for filing tax day, which is determined each year in a different manner. That said, you need to know when the deadline is set by the IRS each year.

W4 Form 2022 Printable Download

W4 Form 2022 Printable

Loading...

Loading...

W4 Form 2022 Spanish

Loading...

Loading...