Table of Contents

What Is A W-4 Form?

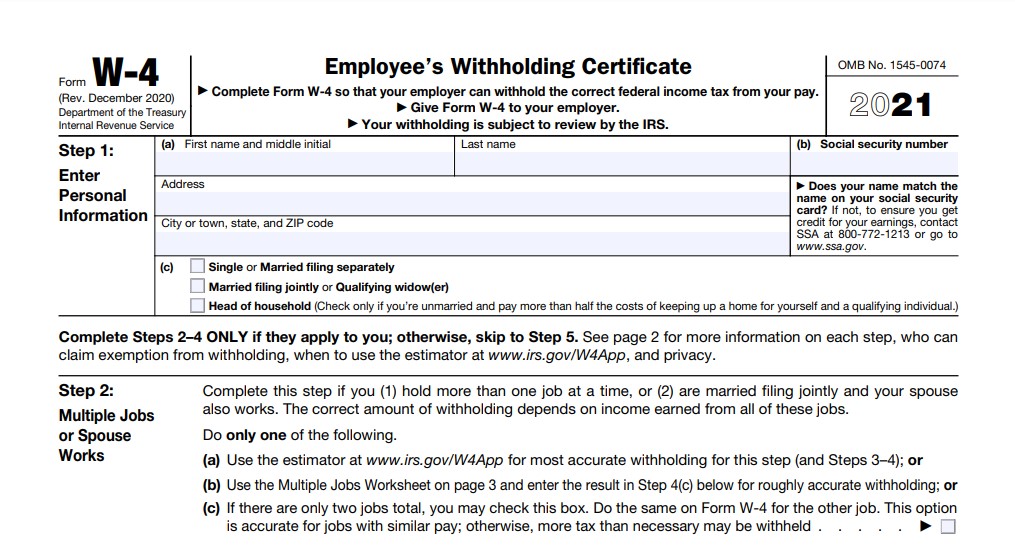

Illinois State Form W4 – Form W-4 is an Worker’s Withholding Allowance Certificate which is completed by an worker in order the right federal revenue tax obligation to be subtracted from his/her repayment. W-4 is usually completed ultimately of a year or when some modifications take place in individual monetary state. Corresponding to monetary information a individual generally gives some individual data such as address, marital standing etc. An individual should take into consideration that there are some instances when exemption from withholding is possible. A person should begin with downloading one of the most suitable fillable layout and afterwards put all essential information according to specified directions. For comfort, an person can fill a document online. Adhering to the directions, count the total up to be deducted and also placed in a sample. After you complete a specific Form, do n`t neglect to inspect if all offered details are right and real . A document has to be licensed with a person’ s signature in order to be regarded a lawfully binding. It is essential to keep in mind that a submitted printable W-4 Form is submitted straight to a landlord yet not to the IRS. On this site you can find different updated PDF examples of this Form. It will take simply a few minutes to create a lawfully binding record and also conveniently print it or onward electronically.

What To Bear In Mind When Finishing Your Form W-4

You can change details on your W-4 as needed. If you start a brand-new task and you’re making the very same pay, for example, you can check package on 2C for both of these jobs.

If your family finances change, and you become responsible for paying most of the expenses, you can alter your condition to head of household which qualifies you to greater common reductions leading to lower tax obligation responsibility.

What’s more, when you finish your W-4, it doesn’t most likely to the IRS however rather to your company that will certainly keep the form on apply for a minimum of four years. The Internal Revenue Service, nonetheless, assesses withholdings, so it is very important to finish your W-4 Form appropriately, or you could end up with a greater tax obligation costs.

Claiming Exempt

If, for instance, you had no tax obligation for the previous year, or for this year, you can declare excluded condition on your W-4. If you pick this choice, you will certainly have to fill out a W-4 Form each year by February 15 (or by the first business day after if the 15th drops on a weekend) to keep your excluded standing.

W4 Form 2021 Printable Download

W4 Form 2021 Printable

Loading...

Loading...

W4V Form 2021 Printable

Loading...

Loading...

W4 Form 2021 Spanish

Loading...

Loading...

State W4 Form 2021 Printable Download

Illionis/il-W4 Form 2021

Loading...

Loading...

Wisconsin/Wi-WT4 Form 2021

Loading...

Loading...

Michigan/Mi-W4 Form 2021

Loading...

Loading...

Oregon/Or-W4 Form 2021

Loading...

Loading...

California/Ca-W4 Form 2021

Loading...

Loading...

Connecticut/CT-W4 Form 2021

Loading...

Loading...