Table of Contents

W4 2022 Form Printable – W4 Form 2022 – In the field of taxation, a lot of people aren’t aware of the terms that are used. Not only that, but the IRS uses a number of forms which, for some individuals, can be difficult to comprehend all the forms. One of the forms you must fill out includes The W4 Form. What exactly is this form? Find the answer in this article below.

What is W4 Form?

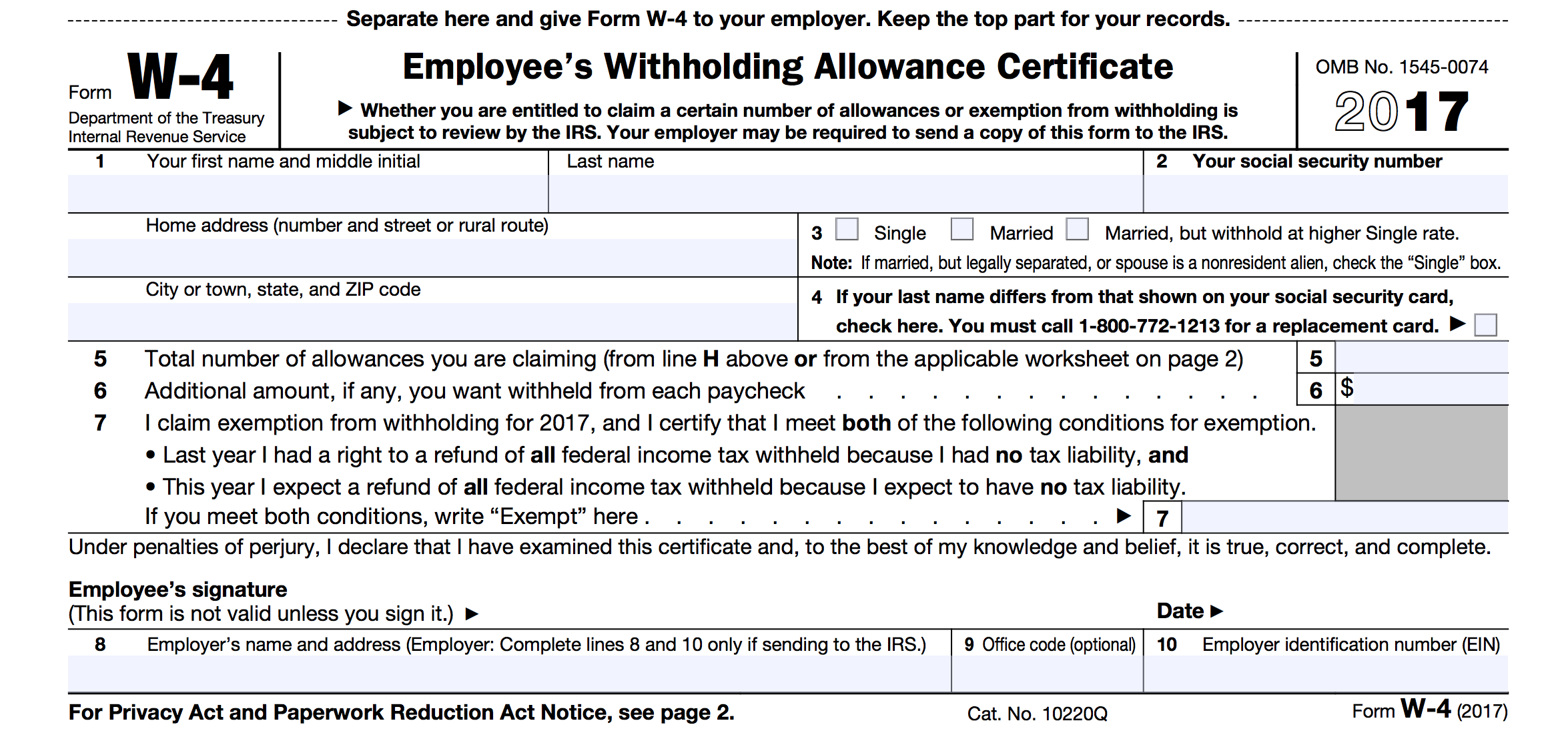

The W4 2022 Form Printable is also known as an alternative name, ‘Employee Withholding Certificate.’ This form is issued by the Internal Revenue Service (IRS) under the Department of the Treasury. Each year the IRS issues the new W4 Form regardless of the similarities that the form is issued each year.

This W4 2022 Form Printable must be completed by an employee of a company. But why should one do this? It is to inform your employer about the additional jobs you have as well as the number of dependents and children you’ve. By informing your employer, your employer can help you to adjust the deductible tax from your paycheck.

What Parts Does W4 Form Have?

There are a lot of sections to fill out this form. The Form itself comprises 4 pages. The practical section is the initial one. The Form’s components W4 will be explained in the following way:

- The first page consists of forms you must fill out. On the 2021 W4 form you’ll notice the steps needed to fill in the blanks at the bottom of this page.

- Second and third page–these pages include general guidelines and specific instructions that you may refer to if you’re not sure how to fill out the form available on the first page. The information you can obtain here is thorough enough to guide you on how to fill in the blanks though.

- The last page (fourth page)–consists of a table which tells that you how much withheld tax from your paycheck.

How to Fill W4 Form

- First, download the form from the official website of the IRS.

- Access the W4 Form using a PDF reader.

- Once you’ve downloaded the files, be sure to go through the general instructions and then the specific instructions which are available on the third and second pages.

- After you’ve completed reading the instructions, you can proceed with filling the Form itself, starting from Step 1 Personal Information.

- Step 2 through step 4 is able to be skipped if you don’t answer the questions in the form. It is not necessary to be a subject for these steps if single, working only, and don’t have dependents or children with you.

- If the steps 2 and 4 are applicable to you, fill it with a true and correct answer. Do not worry, there is a manual that provides guidance about filling in the blanks. You will understand after you have read the general instructions and the specific instructions. The directions that are written on the steps will also be useful to you.

- Once you’ve completed the form then proceed to step 5. In this stage, you’ll have to complete the form and note down the date that you sign on the Form W4.

- In the final step, deliver it to your employer.

We hope the information about W4 2022 Form Printable is helpful for you. Be sure to not exceed the tax filing date, as it is determined each year in a different manner. However, it is important to know when the deadline is set by the IRS every year.

W4 Form 2022 Printable Download

W4 Form 2022 Printable

Loading...

Loading...

W4 Form 2022 Spanish

Loading...

Loading...