Table of Contents

Form W-4 For 2022 – W4 Form 2022 – In the field of taxation, many people do not understand the terms that are used. Additionally, the IRS has a variety of forms that, for certain people, are difficult to grasp all those forms. One of the forms you need to complete can be that of the W4 Form. What is this Form about? You will find the answer in this article below.

What is W4 Form?

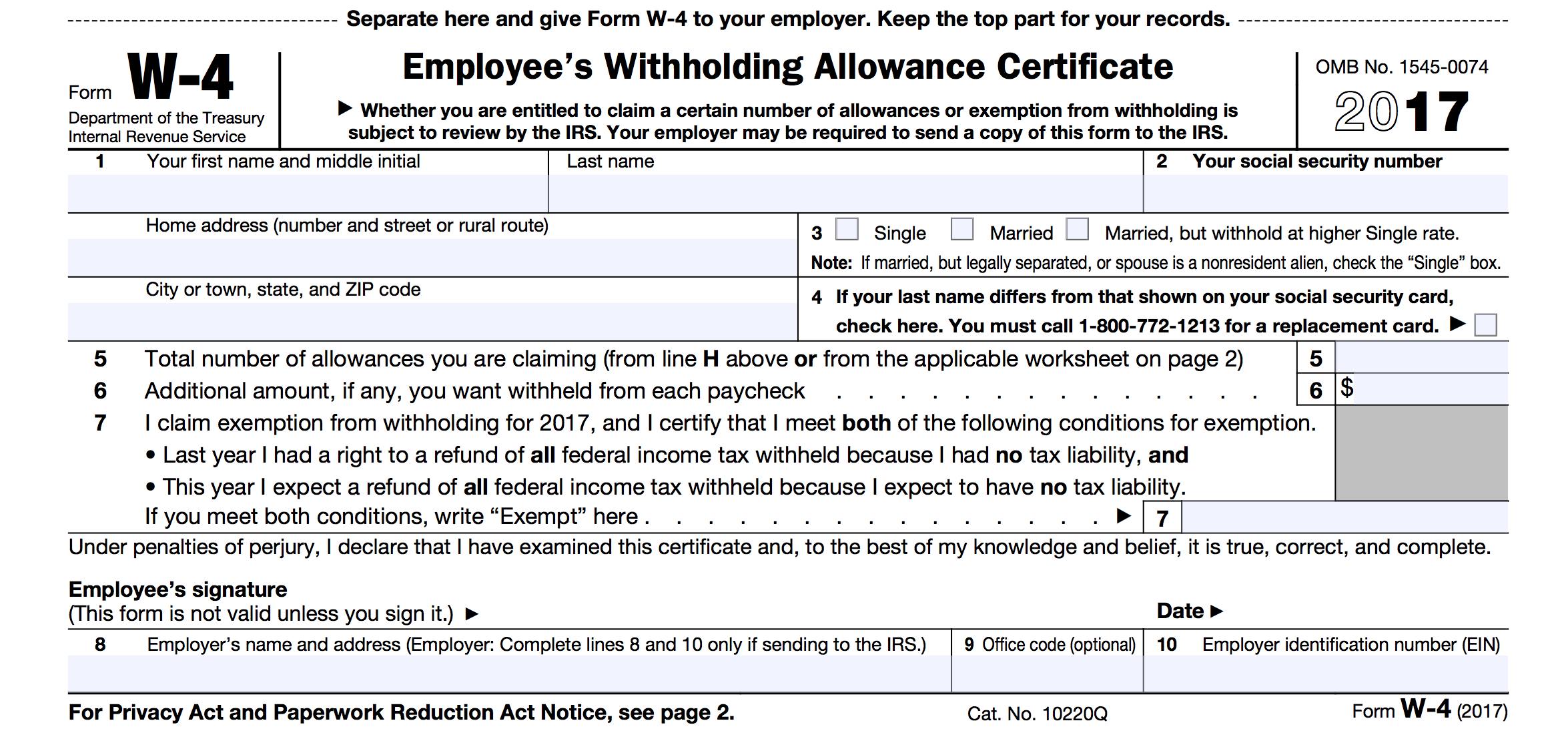

This Form W-4 For 2022 is also referred to as an alternative name, ‘Employee Withholding Certificate.’ The form is issued by Internal Revenue Service (IRS) under the Department of the Treasury. Every year, the IRS issues the new W4 Form, despite the similarity that the Forms for each year are identical.

This Form W-4 For 2022 is mandatory to be filled out by employees of a firm. But why is this? It is to inform your employer about the additional jobs you have and the number of dependents or children you have. By informing your employer that you have a new job, they can assist you to adjust the deductible tax on your salary.

What Parts Does W4 Form Have?

There are numerous sections you can fill out this form. The form itself is made up of four pages, but the functional section is the primary one. Parts of the Form W4 will be described in the following manner:

- The first page–contains the forms that you have to fill in. On the 2021 W4 form you’ll notice there are five steps required to complete the blanks listed within this section.

- The second and third pages include general guidelines and the specific instructions you should refer to when you’re confused on how to fill in the form accessible on the first page. The information you can obtain from this site is enough to explain to you how complete the form though.

- The final page (fourth page)–consists of an information table which will inform that you how much tax withheld from your paycheck.

How to Fill W4 Form

- First, download the form from the official website for the IRS.

- You can open your W4 Form using a PDF reader.

- Once you’ve started the program, you need to read the general instructions and then the specific instructions which are available on the third and second pages.

- After you’ve completed reading the directions, you are now able to proceed with filling the Form itself, starting from Step 1: Personal Information.

- Step 2 until step 4 may be skipped if you don’t apply to the things asked in the form. It is not necessary to be a subject for these steps if you’re single, working only, and do not have children or dependents living with you.

- If steps 2-4 apply to you, then you should fill it with a true and correct answer. Don’t worry since there is a guideline that teaches you what to fill in the blanks. You can understand after reading the general instructions and the specific instructions. The written instructions on the steps will also be helpful for those who are unsure.

- After you’ve completed the form you can proceed to step 5. In this step, you need to take a signature on the form and note down the date that you sign that you have completed the form.

- In the final step, hand it over to your employer.

We hope that the information regarding Form W-4 For 2022 is helpful for you. You should not over the tax filing date, as it is established every year in a different way. This being said, you have to know when the deadline is set by the IRS every year.

W4 Form 2022 Printable Download

W4 Form 2022 Printable

Loading...

Loading...

W4 Form 2022 Spanish

Loading...

Loading...