Table of Contents

What Is A W-4 Form?

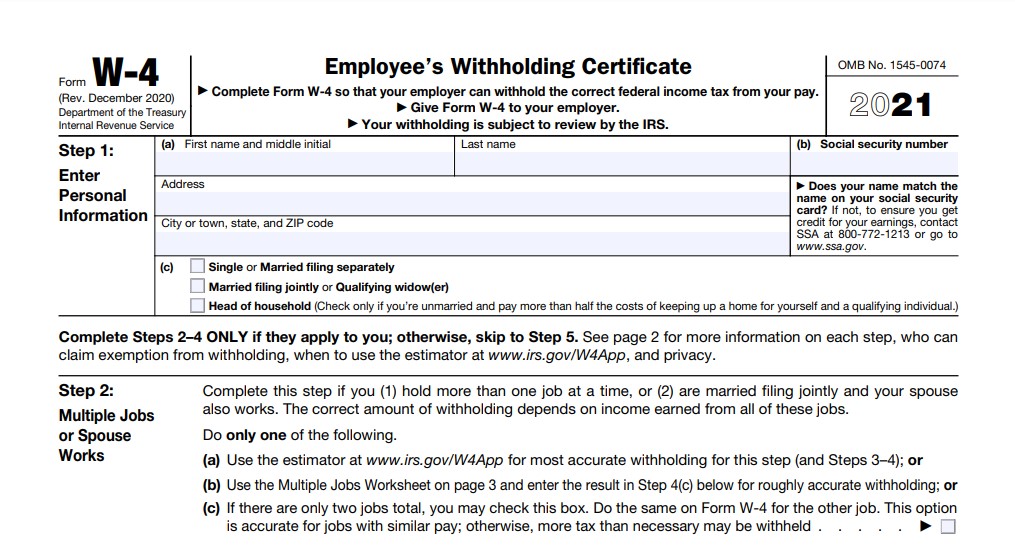

W4 Form For 2021 Printable – Form W-4 is an Employee’s Withholding Allocation Certificate which is completed by an worker in order the correct government income tax to be deducted from his/her repayment. W-4 is usually filled out in the end of a year or when some changes happen in individual financial state. Complementary to financial information a individual typically provides some personal information such as address, marriage status etc. When exemption from withholding is feasible, an person ought to take into account that there are some situations. A individual must begin with downloading one of the most suitable fillable theme and then place all needed details according to specified instructions. For benefit, an individual can fill a file online. Following the directions, count the amount to be deducted and put in a sample. After you finish a particular Form, do n`t neglect to examine if all provided information are real and correct . A record needs to be certified with a person’ s trademark in order to be related to a legally binding. It is essential to bear in mind that a completed W-4 Form is sent straight to a property manager but not to the Internal Revenue Service. On this site you can discover numerous upgraded PDF samples of this Form. It will certainly take simply a couple of mins to develop a lawfully binding document and quickly publish it or ahead electronically.

When Completing Your Form W-4, What To Keep In Mind

You can alter information on your W-4 as needed. If you start a new task and also you’re making the very same pay, for instance, you can check package on 2C for both of these jobs.

If your family funds change, and you end up being responsible for paying a lot of the expenses, you can change your status to head of household which entitles you to greater conventional reductions leading to reduced tax obligation.

What’s even more, when you finish your W-4, it doesn’t most likely to the Internal Revenue Service but instead to your employer who will maintain the form on apply for at the very least 4 years. The IRS, nonetheless, reviews withholdings, so it is necessary to finish your W-4 Form properly, or you can end up with a greater tax obligation expense.

Claiming Exempt

If, for instance, you had no tax obligation for the previous year, or for this year, you can claim exempt condition on your W-4. If you select this alternative, you will certainly have to fill up out a W-4 Form each year by February 15 (or by the first company day after if the 15th falls on a weekend) to preserve your exempt standing.

W4 Form 2021 Printable Download

W4 Form 2021 Printable

Loading...

Loading...

W4V Form 2021 Printable

Loading...

Loading...

W4 Form 2021 Spanish

Loading...

Loading...

State W4 Form 2021 Printable Download

Illionis/il-W4 Form 2021

Loading...

Loading...

Wisconsin/Wi-WT4 Form 2021

Loading...

Loading...

Michigan/Mi-W4 Form 2021

Loading...

Loading...

Oregon/Or-W4 Form 2021

Loading...

Loading...

California/Ca-W4 Form 2021

Loading...

Loading...

Connecticut/CT-W4 Form 2021

Loading...

Loading...