Table of Contents

What Is A W-4 Form?

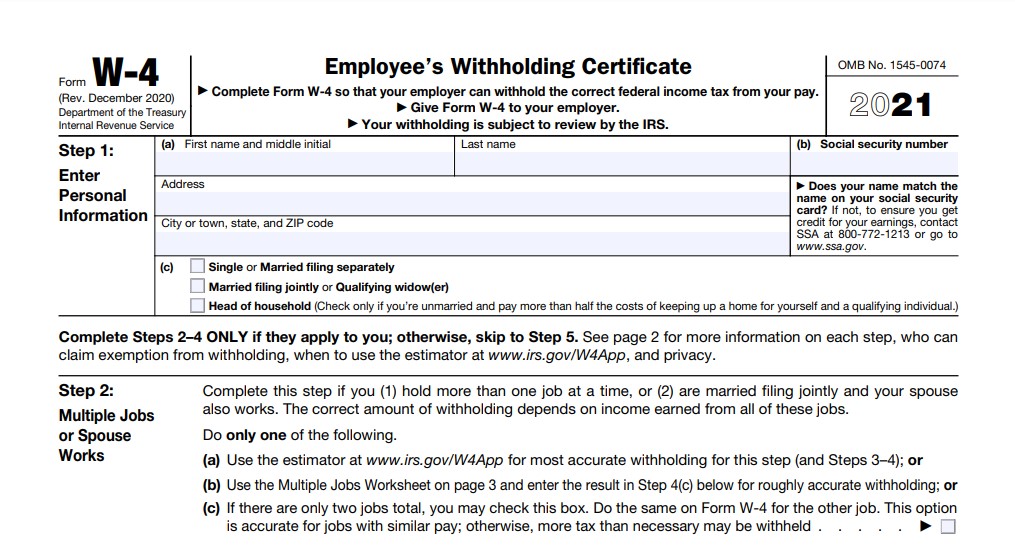

State Of Illinois W4 Form 2021 – Form W-4 is an Employee’s Withholding Allocation Certificate which is filled out by an employee in order the proper federal income tax obligation to be deducted from his/her settlement. W-4 is usually submitted ultimately of a year or when some modifications take place in personal financial state. Corresponding to monetary information a person normally gives some personal information such as address, marriage condition etc. An individual ought to take into consideration that there are some cases when exemption from withholding is possible. A individual ought to begin with downloading and install one of the most appropriate fillable design template and afterwards insert all required details according to defined directions. For comfort, an person can fill a document online. Following the guidelines, count the total up to be deducted and also placed in a example. After you finish a specific Form, do n`t forget to inspect if all supplied details are true as well as right . A document needs to be certified with a individual’ s signature in order to be concerned a legally binding. It is essential to keep in mind that a filled in W-4 Form is submitted directly to a property manager yet not to the IRS. On this internet site you can discover different updated PDF samples of this Form. It will take simply a few minutes to create a legally binding document and also easily print it or onward online.

What To Remember When Finishing Your Form W-4

You can change details on your W-4 as required. If you start a brand-new work and you’re making the exact same pay, for example, you can inspect package on 2C for both of these tasks.

If your home funds change, as well as you end up being in charge of paying most of the bills, you can change your status to head of household which entitles you to greater conventional deductions resulting in reduced tax responsibility.

What’s more, when you finish your W-4, it doesn’t go to the Internal Revenue Service but rather to your employer who will keep the form on declare at the very least four years. The IRS, nevertheless, reviews withholdings, so it is very important to complete your W-4 Form correctly, or you can wind up with a greater tax bill.

Claiming Exempt

Some taxpayers might additionally get approved for excluded standing. If, as an example, you had no tax obligation for the previous year, or for this year, you can assert exempt status on your W-4. Doing so shows to your company to avoid keeping any of your spend for federal tax obligations. If you choose this alternative, you will need to complete a W-4 Form every year by February 15 (or by the very first company day after if the 15th falls on a weekend) to preserve your exempt standing.

W4 Form 2021 Printable Download

W4 Form 2021 Printable

Loading...

Loading...

W4V Form 2021 Printable

Loading...

Loading...

W4 Form 2021 Spanish

Loading...

Loading...

State W4 Form 2021 Printable Download

Illionis/il-W4 Form 2021

Loading...

Loading...

Wisconsin/Wi-WT4 Form 2021

Loading...

Loading...

Michigan/Mi-W4 Form 2021

Loading...

Loading...

Oregon/Or-W4 Form 2021

Loading...

Loading...

California/Ca-W4 Form 2021

Loading...

Loading...

Connecticut/CT-W4 Form 2021

Loading...

Loading...